Battery anodes depend on a supply chain in which China dominates at every stage from feedstock material to active anode material production.

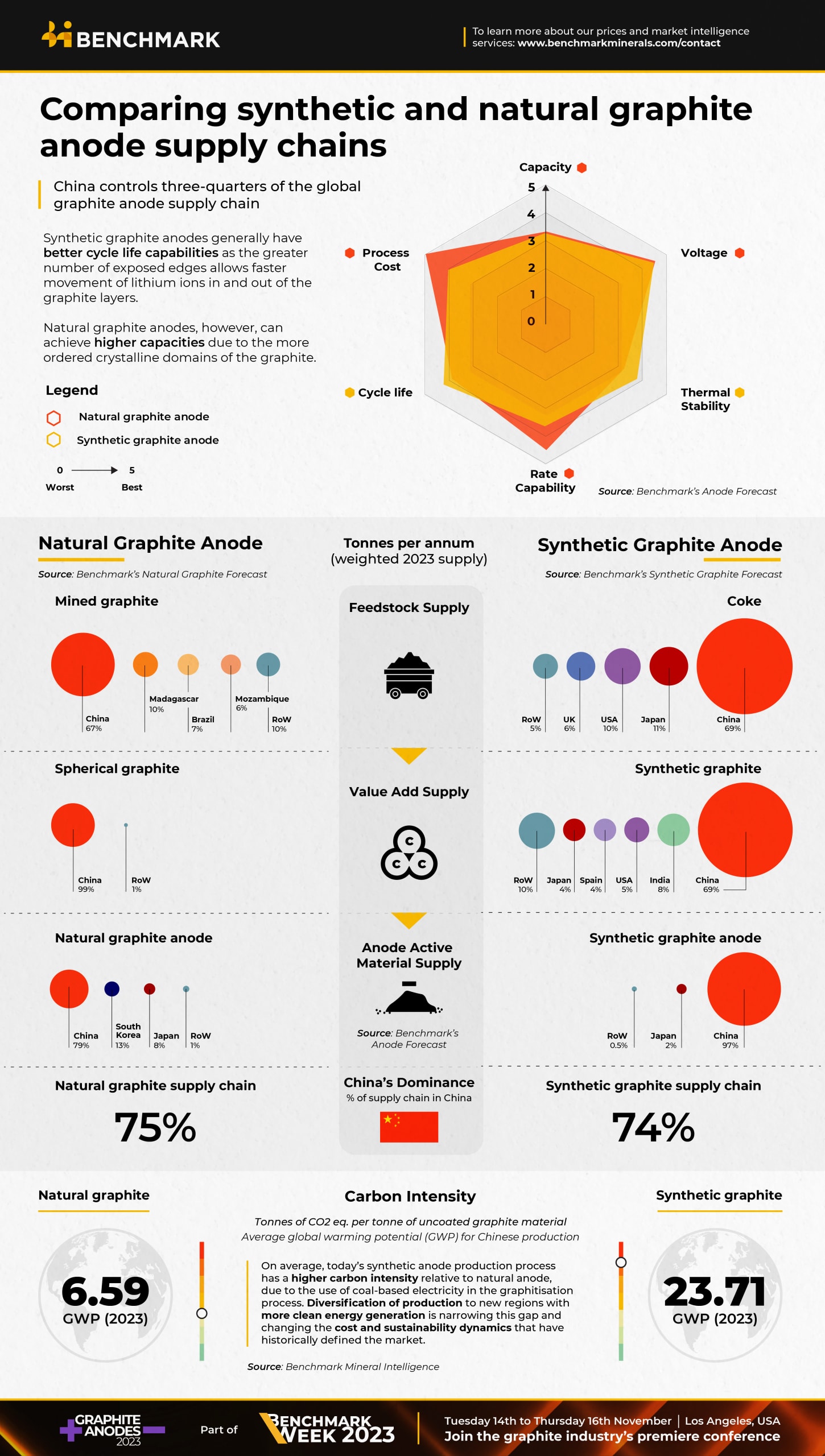

Chinese production represents 74% of the total supply chain for graphite anodes, according to data from Benchmark.

This poses a risk to supply chain security for anode producers in South Korea and elsewhere as China seeks to regulate the exports of its graphite products.

“In addition to China’s current dominance, the nation is on track to retain over 85% of the global anode market share by the end of the decade,” Tony Alderson, an analyst at Benchmark, said. “As such, a notable amount of investment will be required to diversify supply away from China and create a more balanced global landscape.”

The infographic below illustrates the scale of this challenge and the technical and sustainability questions that form part of the graphite dilemma.

During the charging of a battery, lithium ions flow to the anode where they intercalate with the layers of graphite. The reverse process occurs when the battery is discharged.

Both natural and synthetic forms of graphite can be used to make the anode material. Although the two feedstocks produce broadly similar materials, natural graphite anodes offer higher capacities whereas synthetic graphite anodes typically boast longer cycle lifes.

As anode producers seek to maximise these different properties, batteries increasingly contain a blend of both synthetic and natural graphite in their anode materials, though the proportions vary by producer, and ultimately the requirements of the application.

The raw material feedstock for a natural graphite anode is mined flake graphite. This is then separated by size, with the small-to-medium mesh material being the optimal size for battery material processing.

Benchmark’s Natural Graphite Forecast shows that material at this mesh size represented only 49% of a total global market of 1.2 million tonnes of flake graphite concentrate in 2023.

The flake graphite is then micronised, purified and spheronised to produce uncoated spherical graphite, the precursor to natural graphite anode material. Less than 1% of uncoated spherical graphite production is forecast to take place outside of China this year.

For synthetic graphite anodes, the starting material is petroleum coke or coal tar pitch, byproducts of the oil and coal industries. China again dominates, accounting for 69% of global low sulphur petroleum coke production in 2023. Japan and the US represent 11% and 10% of global coke production, respectively.

To convert coke or pitch into synthetic graphite requires the material to undergo an energy intensive graphitisation process. Inner Mongolia in China is home to many graphitisation facilities but the region uses coal for much of its electricity generation. This results in the average synthetic graphite anode material having a carbon intensity over three times that of the average natural graphite anode material produced in China.

Despite these environmental concerns, the cost competitiveness and scale of China’s anode industry means the global market has a major obstacle to overcome in reducing its dependence on China, which stands as high as 99% in some parts of the supply chain.